01.07.2019

Bond yield. In simple words. Bond yield: types, factors of influence

On financial market the investor is interested in the effectiveness of his operations.

For example, person A invested 2 million rubles. for three years and received an amount of 6 million rubles. Person B invested 3 million rubles. for five years, and its result was 10 million rubles. Which of the investment options turned out to be more preferable. It is rather difficult to answer this question using absolute values, since both the amounts and the investment periods differ in the example. The performance of investments is compared using such an indicator as profitability. Yield is relative indicator, which indicates what percentage the ruble of invested funds brings for a certain period. For example, the return on investment is 10%. This means that the invested ruble brings 10 kopecks. arrived. More high level yield means better results for the investor.

In the very general view The rate of return can be defined as the ratio of the result obtained to the costs that brought this result. The return is expressed as a percentage. When we considered the issues of interest calculation, we operated with certain interest rates. Data interest rates are nothing more than indicators of profitability for investors' operations. In financial practice, it is accepted that the rate of return or interest on investments is usually set or determined on a yearly basis, unless otherwise specified. Therefore, if it is said that a certain security brings 20%, then this should be understood as 20% per annum. At the same time, paper can actually circulate on the market for more or less than a year. This practice exists because there is a need to compare the returns on investments that differ in terms of duration. Let's take a look at some of the different types of returns.

Profitability for the period

Period return is the return an investor will receive over a given period of time. It is determined by the formula:

where: r - profitability for the period;

R - originally invested funds; rp is the amount received after n years.

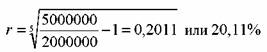

The investor invested 2,000,000 rubles. and received in 5 years 5,000,000 rubles. Determine the profitability of his operation. It is equal to:

![]() The investor's capital grew by 150% in five years.

The investor's capital grew by 150% in five years.

Yield per year

In the financial market, it becomes necessary to compare the returns of various financial instruments. Therefore, the most common rate of return is the return per year. It is defined as the geometric mean, namely:

![]() for a year; n is the number of years.

for a year; n is the number of years.

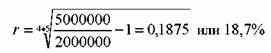

P = 2,000,000 rubles, Pp = 5,000,000 rubles, n = 5 years. Determine the annual return. It is equal to:

, the average investor's annual return was 20.11%.

, the average investor's annual return was 20.11%.

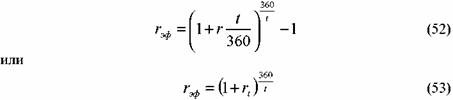

If compound interest is calculated m times a year, then the annual yield is determined by the formula:

The value that is obtained in parentheses on the right side of equation (48) is the return for one period of accrual of the complex period. Therefore, to get the yield per year, multiply by the number of periods.

P = 2,000,000 rubles, Pn = 5,000,000 rubles, n = 5 years, interest is calculated quarterly. Determine the annual return. It is equal to:

If the interest is accrued continuously, then the annual yield can be determined by the formula:

where: rn - yield, presented as a continuously accrued interest.

Until now, we have determined the rate of return on operations that took a period of more than a year. Therefore, the calculations were based on formulas using compound interest. When a financial transaction takes less than a year, as a rule, simple interest is used in calculations. To be more precise, a more stringent criterion here is the ability to invest funds in practice, taking into account compound interest.

For example, if securities with maturity in six months and a year are issued on the market, then the yield on one-year securities should be determined taking into account compound interest. This rule arises because the depositor can receive compound interest within a year by investing his funds first in a six-month paper, and after its redemption, reinvest the funds received in the next six-month paper.

For short-term operations, the yield is determined on the basis of formulas (50) and (51).

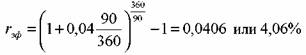

P = 2000000 rubles, Pt = 2020000 rubles, t = 90 days, the financial year is 360 days. Determine the profitability of the investor's operation. It is equal to:

![]() , per year, the profitability of the operation amounted to 4%. For short-term securities, it is also possible to calculate the effective yield, i.e. the effective percentage. For this you can use the following formula(for example, let's take a fiscal year equal to 360 days).

, per year, the profitability of the operation amounted to 4%. For short-term securities, it is also possible to calculate the effective yield, i.e. the effective percentage. For this you can use the following formula(for example, let's take a fiscal year equal to 360 days).

: ref - effective yield per year;

: ref - effective yield per year;

t is the period of the financial transaction (the time from the moment of purchase to the sale or redemption of the security);

r - simple interest per year;

rt - profitability for period t.

Continuing the above example, consider the effective profitability of the operation. It is equal to:

Then formula (53) can also be represented

In our example, the return for 90 days is

If the Imaginary Treasury 3.5% were a perpetual bond, that would be the end of it. But it must be redeemed at its face value of ?100 in 2009. So a buyer in 1999 could say to himself, "I'm paying ?90 for a paper that will pay me ?100 at maturity if I hold it until 2009." In other words, in 2009 I will receive a capital gain of ?10 in addition to the income I have already received. That ?10 is actually a fraction of the total return I would get from the security if I held it. If I spread this ?10 over the ten years that this bond is supposed to be in circulation, it comes out to ?1 per year. So I kind of get ?1 a year on my investment of ?90, which is about 1.11%. This is my gain to redemption. If I add that to the 3.89% yield I get from the coupon, I have a notional combined yield of 5%."

IN real life an investor who made such calculations would grasp general principle, but would err on the details. The calculation of total income requires a compound interest formula and is best done with a computer program or a professional calculator. But he's right, because the Financial Times quotes two yields for every fixed-maturity government bond. The first of these is the interest yield, followed by the redemption yield, which combines the current yield with the notional gain or loss to redemption (see below). If a 2009 Imaginary Treasury 3.5% priced at ?90 shows a current yield of 3.89%, it would actually yield a yield to maturity of approximately 4.78%.

Perhaps the easiest way to understand the principles of circulation associated with fixed interest bonds is to take - as we have done - a bond that trades in the market below its face value of £100 and therefore has a yield to maturity for the investor.

This may be the case if the bond was originally issued during a period of very low interest rates, when investors were expecting a return of only 3.5% more than 3.5% yield on a ten-year bond. Therefore, they would not buy our 2009 Imaginary Treasury 3.5% until the price fell to a level that showed a return on their investment in line with what they could get on comparable bonds: for illustration purposes we took about 4.8%.

In 1999, most government bonds were quoted at around 100. The bonds were issued with large coupons while interest rates were high. When expected yields fell, investors agreed to pay more than its face value of £100 for a bond. In this situation, the buyer would of course be recording a capital loss rather than a capital gain, since the bond would only pay £100 at maturity. In this case, the yield to maturity will be lower than the current yield. The return that the investor receives over the years must be high enough to compensate for the above capital loss on redemption.

Let's take an example At the end of 1999, 2012 Treasury 9% was trading at 134.22. These bonds offered a current yield of 6.57%, but the yield to maturity was only 5.03% if the investor's 2012 redemption loss of £100 was included.

What would you like to achieve by investing in bonds? Save money and earn extra income? Make savings for an important goal? Or maybe you dream about how to get financial freedom with the help of these investments? Whatever the goal, it pays to understand how much your bonds yield and to be able to tell a good investment from a bad one. There are several principles for assessing income, the knowledge of which will help in this.

What types of income do bonds have?

The yield on a bond is the percentage return an investor receives from investing in a bond. Interest income on them is formed from two sources. On the one hand, fixed-coupon bonds, like deposits, have an interest rate that is charged on face value. On the other hand, bonds, like stocks, have a price that can change depending on market factors and the situation in the company. True, changes in the price of bonds are less significant than those of stocks.

The total yield of a bond includes the coupon yield and takes into account the purchase price. In practice, different estimates of profitability are used for different purposes. Some of them show only coupon yield, others additionally take into account the purchase and sale price, others show the return on investment depending on the holding period - before sale on the market or before redemption by the issuer that issued the bond.

To make the right investment decisions, you need to figure out what types of bond yields are and what they show. In total there are three types of profitability, the management of which turns an ordinary investor into a successful rentier. These are the current yield on interest on coupons, yield on sale and yield on securities to maturity.

What does the coupon rate show?

The coupon rate is the base percentage of the face value of the bond, which is also called coupon yield. The issuer announces this rate in advance and periodically pays it in due time. The coupon period of most Russian bonds is six months or a quarter. An important nuance is that the coupon yield on the bond is calculated daily, and the investor will not lose it even if he sells the paper ahead of schedule.

If a bond sale and purchase transaction occurs within the coupon period, then the buyer pays the seller the amount of interest accumulated since the date of the last coupon payment. The amount of these interest is called the accumulated coupon income (ACI) and is added to the current market price of the bond. At the end of the coupon period, the buyer will receive the entire coupon and thus compensate for his expenses related to the reimbursement of ACI to the previous owner of the bond.

Exchange quotes of bonds at many brokers show the so-called net price of the bond, excluding ACI. However, when an investor issues a buy order, the net price will add to the ACI, and the value of the bond may suddenly be higher than expected.

When comparing bond quotes in trading systems, online stores and applications of different brokers, find out what price they indicate: net or with ACI. After that, evaluate the final costs of buying in a particular brokerage company, taking into account all costs, and find out how much money will be written off from your account if you buy securities.

coupon yield

As the cumulative coupon yield (ACY) rises, the value of the bond rises. After the coupon is paid, the cost is reduced by the amount of the ACI.

NKD- accumulated coupon income

WITH(coupon) - the amount of coupon payments for the year, in rubles

t(time) - number of days since the beginning of the coupon period

Example: the investor bought a bond with a face value of 1000 ₽ with a semi-annual coupon rate of 8% per year, which means a payment of 80 ₽ per year, the transaction took place on the 90th day of the coupon period. His surcharge to the previous owner: ACI = 80 * 90 / 365 = 19.7 ₽

Is the coupon yield the investor's interest?

Not really. Each coupon period, the investor receives the amount of certain interest in relation to the face value of the bond to the account that he specified when concluding the agreement with the broker. However, the real interest that the investor receives on the invested funds depends on the purchase price of the bond.

If the purchase price was higher or lower than the face value, then the yield will differ from the base coupon rate set by the issuer in relation to the face value of the bond. The easiest way to estimate the real return on an investment is to relate the coupon rate to the purchase price of the bond using the current yield formula.

From the presented calculations using this formula, it can be seen that the yield and price are inversely related to each other. An investor receives a lower yield to maturity than was set by the coupon when he buys a bond at a price higher than par.

CY

C g (coupon) - coupon payments for the year, in rubles

P(price) - purchase price of the bond

Example: the investor bought a bond with a face value of 1000 ₽ at a net price of 1050 ₽ or 105% of the face value and a coupon rate of 8%, i.e. 80 ₽ per year. Current yield: CY = (80 / 1050) * 100% = 7.6% per annum.

Profitability fell - the price rose.

I'm not kidding?

This is true. However, for novice investors who are not very clear on the distinction between yield to sell and yield to maturity, this is often a difficult moment. If we consider bonds as a portfolio of investment assets, then its yield to sale in the event of a price increase, like that of stocks, of course, will increase. But the yield of bonds to maturity will change differently.

The thing is that a bond is a debt obligation, which can be compared with a deposit. In both cases, when buying a bond or placing money on deposit, the investor actually acquires the right to a stream of payments with a certain yield to maturity.

As you know, interest rates on deposits rise for new depositors when money depreciates due to inflation. Also, the yield to maturity of a bond always rises when its price falls. The opposite is also true: yield to maturity falls when the price rises.

Beginners who evaluate returns in bonds on the basis of comparison with stocks may come to another erroneous conclusion. For example: when the price of a bond has grown, say, up to 105% and has become more than the face value, then it is not profitable to buy it, because only 100% will be returned upon repayment of the principal debt.

In fact, it is not the price that matters, but the yield of a bond - a key parameter for assessing its attractiveness. Market participants, when trading for a bond, only agree on its yield. The price of a bond is a derivative of the yield. In fact, he adjusts the fixed coupon rate to the level of the rate of return agreed upon by the buyer and seller.

How yield and price of a bond are related, see the video of the Khan Academy, an educational project created with money from Google and the Bill and Melinda Gates Foundation.

What is the yield on selling the bond?

The current yield shows the ratio of coupon payments to the market price of the bond. This indicator does not take into account the investor's income from changes in its price upon redemption or sale. To evaluate the financial result, you need to calculate the simple yield, which includes a discount or premium to the face value upon purchase:

Y(yield) - simple yield to maturity / offer

CY(current yield) - current yield, from coupon

N

P(price) - purchase price

t(time) - time from purchase to maturity/sale

365/t- multiplier for converting price changes into percentages per annum.

Example 1: the investor purchased a two-year bond with a face value of 1000 ₽ at a price of 1050 ₽ with a coupon rate of 8% per annum and a current coupon yield of 7.6%. Simple yield to maturity: Y 1 = 7.6% + ((1000-1050)/1050) * 365/730 *100% = 5.2% per annum

Example 2: the issuer was upgraded 90 days after the purchase of the bond, after which the price of the paper rose to 1070 ₽, so the investor decided to sell it. Let's replace in the formula the face value of the bond with the price of its sale, and the term to maturity - with the holding period. We get a simple yield to sell: Y 2 7.6% + ((1070-1050)/1050) * 365/90 *100% = 15.3% per annum

Example 3: The buyer of a bond sold by a previous investor paid ₽1,070 for it, more than it was worth 90 days ago. Since the price of the bond has risen, the simple yield to maturity for a new investor will no longer be 5.2%, but less: Y 3 = 7.5% + ((1000-1070)/1070) * 365/640 * 100% = 3 .7% per annum

In our example, the price of a bond increased by 1.9% in 90 days. In terms of annual yield, this amounted to a serious increase in interest payments on the coupon - 7.72% per annum. With a relatively small change in price, bonds for a short period of time can show a sharp jump in profits for the investor.

After a bond is sold, an investor may not receive the same 1.9% return every three months for a year. Nevertheless, the yield, converted into annual percentages, is an important indicator that characterizes the current cash flow of an investor. With its help, you can make a decision on the early sale of a bond.

Consider the reverse situation: when the yield increases, the price of the bond decreases slightly. In this case, the investor may receive a loss in case of early sale. However, the current yield from coupon payments, as can be seen in the above formula, will most likely cover this loss, and then the investor will still be in the black.

The least risk of loss of invested funds in case of early sale are bonds of reliable companies with a short term to maturity or redemption by offer. Strong fluctuations in them can be observed, as a rule, only during periods of economic crisis. However, their market value recovers fairly quickly as the economy improves or the maturity date approaches.

Transactions with more reliable bonds mean less risk for the investor, but the yield to maturity or put on them will be lower. This general rule the ratio of risk and profitability, which also applies to the purchase and sale of bonds.

How to get the most out of a sale?

So, as the price rises, the yield on a bond falls. Therefore, in order to get the maximum benefit from a rise in the price of an early sale, you need to choose bonds whose yields are likely to decline the most. Such dynamics, as a rule, show papers of issuers that have the potential to improve their financial position and credit ratings.

Large changes in yield and price can also show bonds with a long maturity. In other words, long bonds are more volatile. The thing is that long-term bonds form a larger cash flow for investors, which has a stronger effect on price changes. How this happens is best illustrated by the example of the same deposits.

Suppose a depositor placed money on deposit at a rate of 10% per annum for three years a year ago. And now the bank accepts money for new deposits already at 8%. If our depositor could assign the deposit, like a bond, to another investor, then the buyer would have to pay an additional 2% difference for each remaining year of the deposit agreement. The additional payment in this case would be 2 g * 2% = 4% on top of the amount of money in the deposit. For a bond purchased under the same conditions, the price would rise to approximately 104% of the face value. The longer the term, the higher the premium for the bond.

Thus, the investor will get more profit from the sale of bonds if he chooses long bonds with fixed coupon when rates in the economy go down. If interest rates, on the contrary, rise, then it becomes unprofitable to hold long bonds. In this case, it is better to pay attention to fixed-coupon securities with a short maturity, or bonds with floating rate.

What is the effective yield to maturity?

The effective yield to maturity is the investor's total return on investments in bonds, taking into account the reinvestment of coupons at the initial investment rate. To assess the total yield to maturity of a bond or its redemption under an offer, a standard investment indicator is used - the rate of internal return on cash flow. It shows the average annual return on investments, taking into account payments to the investor in different periods time. In other words, it is the return on investment in bonds.

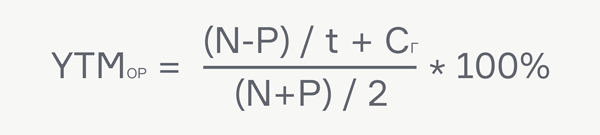

You can independently calculate the estimated effective yield using a simplified formula. The calculation error will be tenths of a percent. The exact yield will be slightly higher if the purchase price exceeded par, and slightly less if it was below par.

YTM op (Yield to maturity) - yield to maturity, estimated

C g (coupon) - the amount of coupon payments for the year, in rubles

P(price) - current market price of the bond

N(nominal) - face value of the bond

t(time) - years to maturity

Example 1: the investor purchased a two-year bond with a face value of 1000 at a price of 1050 ₽ with a coupon rate of 8% per annum. Estimated effective yield to maturity: YTM 1 = ((1000 - 1050)/(730/365) + 80) / (1000 + 1050) / 2 * 100% = 5.4% per annum

Example 2: the issuer was upgraded 90 days after the purchase of the bond, and its price rose to 1070 ₽, after which the investor decided to sell the bond. Let's replace in the formula the face value of the bond with the price of its sale, and the term to maturity - with the holding period. Let's get the estimated effective yield to sell (horizon yield): HY 2 = ((1070 - 1050)/(90/365) + 80) / (1000 + 1050) / 2 * 100% = 15.7% per annum

Example 3: The buyer of a bond sold by a previous investor paid ₽1,070 for it, more than it was worth 90 days ago. Since the price of the bond has risen, the effective yield to maturity for a new investor will no longer be 5.4%, but less: YTM 3 = ((1000 - 1070)/(640/365) + 80) / (1000 + 1050) / 2 * 100% = 3.9% per annum

The easiest way to find out the effective yield to maturity for a particular bond is to use the bond calculator on the Rusbonds.ru website. An accurate calculation of the effective return can also be obtained using a financial calculator or the Excel program through the special function “internal rate of return” and its varieties (XIRR). These calculators will calculate the effective rate of return using the formula below. It is calculated approximately - by the method of automatic selection of numbers.

How to find out the yield of a bond, see the video high school Economics with Professor Nikolai Berzon.

The most important!

✔ The key parameter of a bond is its yield, the price is a derived parameter from the yield.

✔ When a bond's yield falls, its price rises. Conversely, as yields rise, the price of a bond falls.

✔ You can compare comparable things. For example, the net price without ACI - with the net price of the bond, and the full price with ACI - with the full price. This comparison will help you make a decision when choosing a broker.

✔ Short one-two-year bonds are more stable and less dependent on market fluctuations: investors can wait for the maturity date or the redemption by the issuer under the offer.

✔ Long fixed-coupon bonds with lower rates in the economy allow you to earn more on their sale.

✔ A successful rentier can receive three types of income in bonds: from coupon payments, from a change in the market price when sold, or from recovering face value when redeemed.

Intelligible dictionary of terms and definitions of the bond market. Reference base for Russian investors, depositors and rentiers.

Discount bonds- discount to the face value of the bond. A bond that is priced below par is said to be selling at a discount. This occurs if the seller and the buyer of the bond have agreed on a higher rate of return than is set by the coupon issuer.

Coupon yield of bonds- this is the annual interest rate that the issuer pays for the use of borrowed funds raised from investors through the issuance of securities. Coupon income is accrued daily and is calculated at the rate of the face value of the bond. The coupon rate can be constant, fixed or floating.

Coupon period of a bond- the period of time after which investors receive interest accrued on the nominal value of the security. The coupon period of most Russian bonds is a quarter or half a year, less often a month or a year.

Bond premium- increase to the face value of the bond. A bond that is priced above par is said to be selling at a premium. This happens if the seller and the buyer of the bond have agreed on a lower rate of return than the coupon set by the issuer.

Simple yield to maturity/offer- is calculated as the sum of the current yield from the coupon and the yield from the discount or premium to the face value of the bond, as a percentage per annum. Simple yield shows the investor the return on investment without coupon reinvestment.

Simple yield to sell- is calculated as the sum of the current yield from the coupon and the yield from the discount or premium to the bond's selling price, as a percentage per annum. Since this yield depends on the bond's selling price, it can be very different from the yield to maturity.

Current yield, from coupon- is calculated by dividing the annual cash flow from coupons by the market price of the bond. If we use the purchase price of a bond, then the resulting figure will show the investor the annual return on his cash flow from coupons on invested funds.

Bond full price- the sum of the market price of the bond as a percentage of the face value and the accumulated coupon income (ACI). This is the price an investor will pay when buying a paper. The investor compensates for the costs of paying the ACI at the end of the coupon period, when he receives the entire coupon.

Bond net price- the market price of the bond as a percentage of the face value, excluding accumulated coupon income. It is this price that the investor sees in the trading terminal, it is used to calculate the profitability received by the investor on the invested funds.

Effective yield to maturity / offer- the average annual yield on initial investments in bonds, taking into account all payments to the investor in different periods of time, the redemption of the face value and income from reinvestment of coupons at the rate of initial investments. To calculate the profitability, the investment formula of the rate of internal profitability of the cash flow is used.

Effective yield to sell- the average annual yield on initial investments in bonds, taking into account all payments to the investor in different periods of time, proceeds from the sale and income from reinvestment of coupons at the rate of initial investments. The effective yield to sell measures the return on investment in bonds over a given period.